Get the Editor’s Digest for free

FT editor Roula Khalaf has chosen her favorite stories in this weekly newsletter.

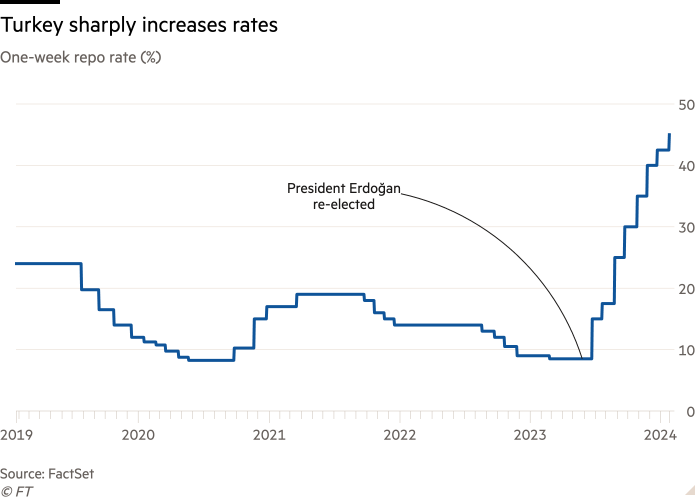

Turkey raised interest rates to 45 percent as policymakers signaled the country’s long-running inflation crisis is expected to ease this year, ending an eight-month campaign of sharply raising borrowing costs.

The central bank raised its benchmark one-week repo rate by 2.5 percentage points on Thursday, as expected, marking the eighth rise in borrowing costs since June.

The central bank’s policy-making committee said that although inflation remains near 65% and could rise further in the coming months, “domestic demand remains weak as expected as monetary tightening is reflected in financial conditions. “Recent indicators suggest that the economy continues to ease along a deinflationary process.”

“Given the delayed effects of monetary tightening, the Committee assesses that the monetary tightening necessary to establish a course of deflation has been achieved and that this level will be maintained for as long as necessary,” it added.

The central bank’s move is the latest sign that Turkish President Recep Tayyip Erdogan, who once called high interest rates the “root of all evil,” has begun a sharp shift toward more conventional economic policy after his reelection. It’s a sign. May.

The central bank, chaired by former Goldman Sachs banker Hafizeh Gaye Erkan, said inflation could exceed 70 percent by the summer but would fall sharply to 36 percent by the end of the year.

Goldman Sachs said this month that inflation will ease more quickly this year than central banks expected. The Wall Street bank said in a note to clients that it expects inflation to fall to 33% by the end of 2024.

Turkey has also launched a wide-ranging economic reform program aimed at rebuilding the central bank’s foreign currency war chest and cooling rampant consumer demand that has pushed Turkey’s current account deficit to record levels.

Erkann, who has played a key role in economic reforms, has been in office for seven months after local media reported in recent days allegations that his father had taken an unofficial position at the central bank and fired staff. faced one of the most serious trials. .

Recommendation

The central bank’s first female governor strongly denied the accusations, calling them “baseless” and “totally unacceptable.” On Wednesday, President Recep Tayyip Erdogan appeared to express his support for Erkan, saying that the anonymous attackers were “running a campaign to destroy the climate of trust and stability that we have achieved with great pains in the economy through unwarranted rumors.” “

As the campaign heats up for major local elections in March, the turmoil has sparked a stir among domestic and foreign investors, which was aroused in the past when President Erdoğan sacked central bank governors for their longstanding opposition to high interest rates. They are being watched closely by others.

Foreign investors, who had all but abandoned Turkey’s domestic market in recent years, have widely praised the new economic plan.

Pimco, one of the world’s largest bond fund managers, told the Financial Times this month that it was “very positive” about Turkey’s domestic assets and had been entering the domestic bond market in recent months.