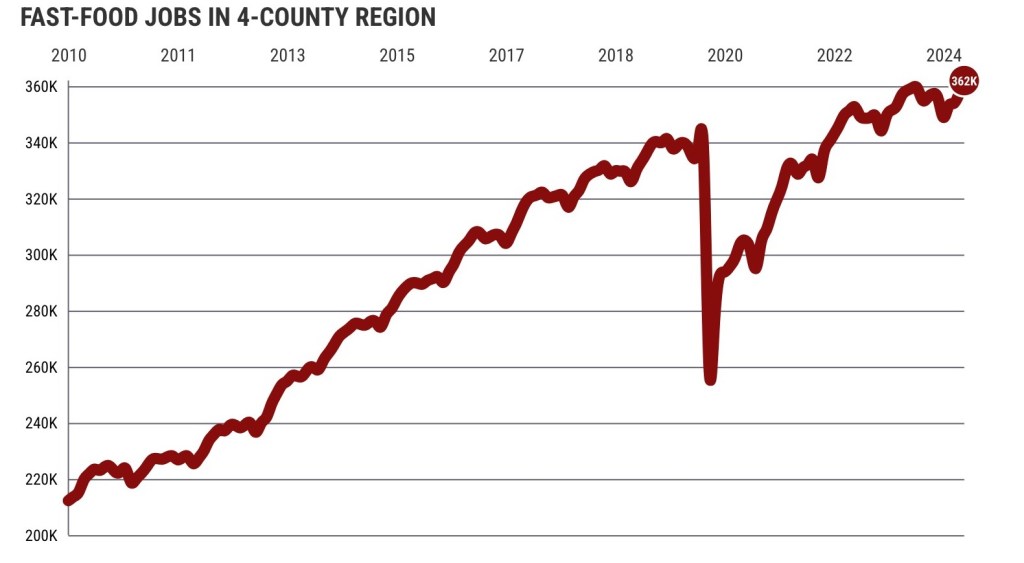

According to the Employment Development Department’s May employment report, there were 362,000 employees working at limited-service restaurants in Los Angeles, Orange, Riverside and San Bernardino counties, up 4,800 from the previous month.

Southern California fast-food operators added a record 4,800 workers in May, offering an early glimpse into how a controversial minimum wage increase for many fast-food workers could change the industry.

I checked the Employment Development Department’s employment numbers on my trusty spreadsheet and found that there are 362,000 employees working at limited-service restaurants in Los Angeles, Orange, Riverside and San Bernardino counties, up 4,800 from May and beating the previous record of 359,400 set in July 2023.

These employment statistics don’t account for seasonal fluctuations, so we looked at May hiring patterns from 2015 to 2019, a more normal time before the coronavirus upended the economy. The May 2024 increase was nearly double the industry average of 2,760 over that five-year period. For comparison, local fast food employment increased by 5,200 in one year.

The hiring comes after the largest fast-food chains raised their minimum wage by $4 to $20 in April. Industry leaders have been outraged by the financial burden, saying the wage hike will force them to raise food prices and cut jobs. Monthly employment data does not track hours worked in the fast-food industry.

Strong spending

To be sure, a month or so of hiring patterns doesn’t tell the whole story, and wage increases would certainly pose an additional hurdle for fast-food operators operating in an already costly business environment.

Perhaps this early sign of wage growth and hiring is unique to Southern California: Elsewhere in California, fast-food workers totaled 383,600 in May, up just 1,300 in a month but below the 2015-19 average of 3,580 employees. These operators have cut 2,200 jobs in the past year.

Right now, local fast-food payrolls are likely to remain strong because that key variable — the overall health of the economy — remains relatively strong, which is why Southern California consumers will continue to dine out.

Consider the May employment picture for all other food and beverage establishments in Southern California: Full-service restaurants and foodservice businesses employed 342,100 people, up 3,100 in one month compared to an average May employment of 1,760 from 2015 to 2019. Employment in this niche increased by 4,200 in one year.

If you want further signs of robust consumer spending, consider job growth in another sector of Southern California’s hospitality industry: hotel, entertainment and recreation employees. These industries employ 269,800 people, up 4,700 in one month compared to an average employment of 2,580 from 2015 to 2019. Over the course of the year, these business owners added 5,300 jobs.

The local economy continues to be in growth mode: Across all industries in Southern California, 7.99 million people were employed in May, up 19,800 in the month and 63,100 in the year.

Industry Fluctuations

Seven of Southern California’s 11 other major business sectors saw employment gains in May, ranked by month-over-month change.

Government: 1.04 million workers – an increase of 4,100 in one month compared to an average employment of 2,400 between 2015 and 2019. An increase of 24,000 in the past year.

Construction: 373,100 workers – 2,900 month-on-month growth versus average employment of 2,660. Annual growth of 2,600.

Personal Services: 270,200 employees – 2,700 monthly growth for an average employment of 1,000. 7,700 annual growth.

Professional and business services: 1.12 million workers – an increase of 1,800 per month compared to an average decrease of 1,500. A decrease of 20,500 for the year.

Retail: 727,600 employees – 1,500 monthly increases versus an average of 1,100. Down 1,300 for the year.

Finance: 357,200 employees – 1,200 monthly growth vs. average of 1,140. 2,100 annual decline.

Logistics & Utilities: 800,400 employees – 1,100 month-on-month growth compared to an average of 3,140. Year-on-year decline of 1,700.

Information: 219,900 employees – 200 fewer employees per month compared to an average reduction of 860. A reduction of 15,600 employees per year.

Health and social services: 1.32 million workers – down 1,100 per month, compared with an average of 3,840 jobs, and up 58,300 for the year.

Manufacturing: 563,400 employees – a decrease of 1,400 per month compared to an average of 460 jobs. A decrease of 10,700 for the year.

Private education: 212,600 employees – a decrease of 5,500 per month compared to an average reduction of 3,260. An increase of 7,600 per year.

Jonathan Lansner is a business columnist for the Southern California News Group. He can be reached at jlansner@scng.com.