xyom

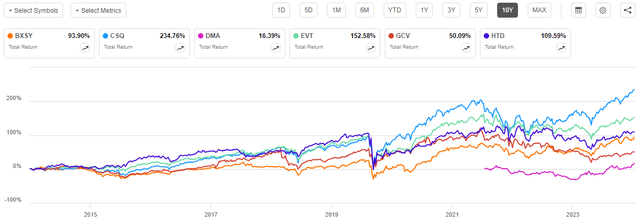

The Bexil Investment Trust (OTCPK:BXSY) is a closed-end fund, or CEF, that income-focused investors can employ as a method of achieving their goals. This is not an especially well-known fund, despite being created back in 1998. This may partly be due to the fund’s somewhat poor performance history, as its share price has declined by 19.82% over the past ten years:

Seeking Alpha

This was a period of time in which the S&P 500 Index (SP500) and most other assets experienced tremendous appreciation. As we can see above, the S&P 500 Index itself increased in price by 183.86% over the period, which is almost a tripling. It is certainly not unexpected for a fund that underperforms to such a degree to not be especially well-followed in the investment community.

However, investors in this fund have actually done quite a bit better than the share price performance above would suggest. As I stated in a recent article:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

When we consider the impact of the distributions that this fund paid out over the period, we get this alternative chart:

Seeking Alpha

As shown, shareholders of the Bexil Investment Trust have realized a 93.90% total return over the past ten years. This is still nowhere near as good as the total return of the S&P 500 Index, but it is much better than the loss that was implied by the price performance alone. In other words, investors who reinvested all the distributions paid by this fund over the period would have roughly doubled their money.

The fact that the fund’s total return has been so much better than its price return might lead one to conclude that the fund must have a very high yield. This is mostly true, as the Bexil Investment Trust boasts a 7.70% yield at the current price. This is much more attractive than the 1.30% yield currently possessed by the S&P 500 Index, and indeed it is better than the yield possessed by most domestic indices. However, it is not particularly impressive when compared to the fund’s peers:

Fund Name

Morningstar Classification

Current Yield

Bexil Investment Trust

Hybrid-U.S. Allocation

7.70%

Calamos Strategic Total Return Fund (CSQ)

Hybrid-U.S. Allocation

7.14%

Destra Multi-Alternative Fund (DMA)

Hybrid-U.S. Allocation

0.63%

Eaton Vance Tax-Advantaged Dividend Income Fund (EVT)

Hybrid-U.S. Allocation

8.31%

Gabelli Convertible & Income Securities Fund (GCV)

Hybrid-U.S. Allocation

13.04%

John Hancock Tax-Advantaged Dividend Income Fund (HTD)

Hybrid-U.S. Allocation

8.18%

Click to enlarge

We can immediately see that despite its impressive yield compared to the indices, the Bexil Investment Trust is in the bottom half of its peer group. This alone might not be enough to discourage all investors, and admittedly, there are some who may wish to have a lower yield for tax purposes. However, most of these funds have outperformed the Bexil Investment Trust by quite a lot over the past ten years:

Seeking Alpha

As we can see, the only fund that underperformed the Bexil Investment Trust is the Gabelli Convertible & Income Securities Fund. The Destra Multi-Alternative Fund also arguably underperformed, but its inception date was in January 2022, so it is not really comparable. Overall, investors would have been better off with most of the fund’s peers over the past decade. This might be another reason for the fund’s seeming lack of popularity.

We should always keep in mind, however, that past performance is no guarantee of future results. The simple fact that the Bexil Investment Trust has underperformed over the past decade is no guarantee that it will underperform over the next decade. As such, we should take a look at the fund’s holdings, positioning, and finances as they stand today to make a reasonable guess about how it will perform going forward. The remainder of this article will focus specifically on this task.

About The Fund

The website of the Bexil Investment Trust is quite spartan, to say the least. It does state that the fund’s primary objective is to provide its investors with current income. It also claims to have a secondary goal of capital appreciation. However, the website says nothing about how the fund seeks to achieve this goal. The fact sheet offers a bit more information, fortunately, stating:

Under normal circumstances, at least 50% of its total assets are invested in income generating equity securities.

The Fund’s strategy is to seek companies with strong operations showing superior returns on equity and assets with reasonable valuations. Generally, the Fund purchases and holds income generating equity securities of profitable, growing, and conservatively valued companies across a broad range of industries.

This description basically states that the Bexil Investment Trust invests in dividend-paying value stocks. That works pretty well with its stated objectives of providing both current income and capital appreciation. After all, the current income comes from the dividends paid by the common stocks. The fact that the fund is investing in common stocks rather than fixed-income securities provides the capital appreciation that the fund seeks as its secondary objective. After all, one of the major advantages of common stocks is that they theoretically have unlimited upside potential.

The fund’s description also explicitly states that it focuses its attention on value stocks. This might explain some of the underperformance that this fund experienced over the past decade. As I pointed out in a few previous articles (see here and here), an outsized proportion of the total returns of the S&P 500 Index over the past fifteen years have been due to a handful of stocks. These stocks are Microsoft (MSFT), Apple (AAPL), Meta Platforms (META), Netflix (NFLX), Alphabet (GOOGL), Tesla (TSLA), Nvidia (NVDA), Amazon (AMZN), and one or two others. These companies are not value stocks by any stretch of the imagination, and most of them did not pay a dividend until very recently. Even among these companies that do pay a dividend, their yields are so low that they cannot really be classified as “dividend stocks.”

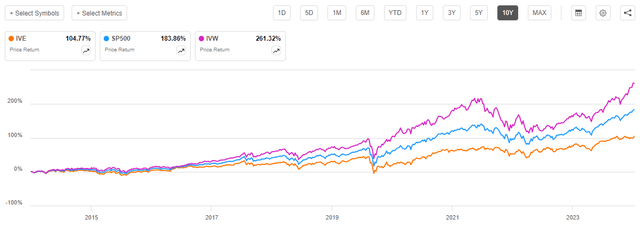

We can see how stark the performance between value and growth stocks has been by looking at this chart:

Seeking Alpha

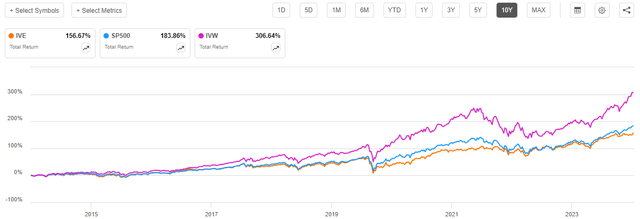

This chart shows the iShares S&P 500 Value ETF (IVE) and the iShares S&P 500 Growth ETF (IVW) against the full S&P 500 Index over the past ten years. The companies in the value index do tend to have higher dividend yields than those in the growth index, but even the inclusion of these larger dividends is not sufficient to fully close the gap:

Seeking Alpha

We still see that growth stocks have delivered roughly double the return of value stocks, and value stocks have still underperformed the broad index on a total return basis. The conclusion that we can draw from this is that any fund that invests mostly or solely in value stocks will have underperformed over much of the past decade.

Some readers might immediately notice that the fund’s fact sheet states that only 50% of the fund’s assets have to be invested in value-priced dividend-paying stocks. The fund’s classification as a hybrid fund suggests that some portion of the remainder may consist of bonds or other fixed-income products. This would make sense given the fund’s focus on income, as bonds usually have higher yields than common stocks. This is certainly true today, as the S&P 500 Value Index only has a 1.79% yield compared to the 3.44% yield of the Bloomberg U.S. Aggregate Bond Index (AGG). However, bonds do not possess the same potential for capital appreciation, so during inflationary times they tend not to maintain their purchasing power as well as common equities.

The fund’s 2023 annual report states that the fund’s portfolio as of December 31, 2023 consisted of the following:

Asset Type

% of Net Assets

Common Stocks

108.34%

Corporate Bonds and Notes

0.04%

Master Limited Partnerships

0.44%

Preferred Stocks

1.25%

Click to enlarge

This is certainly not what I expected to see when I read the description of the fund’s strategy provided in the fact sheet. At the start of the year, the Bexil Investment Trust was almost entirely invested in common stocks, which only a tiny allocation to corporate bonds and preferred stock. The fund also has a small allocation to master limited partnerships for income, but it is certainly not enough to make any real difference to the portfolio’s performance. Indeed, as I pointed out in a recent article, master limited partnerships have actually been outperforming the S&P 500 Index over the past three years. Thus, having a higher weighting to these assets might have improved the performance of the Bexil Investment Trust. Of course, there are very few funds apart from energy infrastructure funds that have any noticeable allocation to this asset type.

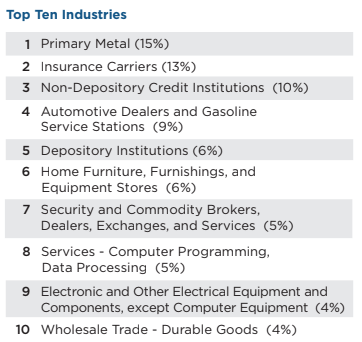

As I noted in articles about the John Hancock Tax-Advantaged Dividend Income Fund (such as this one), utility companies tend to be a fairly common holding among funds that want to provide a high level of income without sacrificing the upside potential of common equities. The Bexil Investment Trust is different, though, as its portfolio consists heavily of basic materials producers and various types of financial firms:

Fund Fact Sheet

This is an entirely unique portfolio than most other closed-end funds possess. In fact, I do not believe that I have ever seen one that is weighted towards primary metals, insurance companies, banks, and companies that make money from the servicing of automobiles. Preferred stock funds will frequently have exposure to banks and insurance companies, but those funds are buying the preferred shares issued by these entities. The Bexil Investment Trust is purchasing common stock, which will have an entirely unique return profile.

The fact that this fund’s sector and industry holdings are very different from most funds might be attractive to those investors who are looking to add a degree of diversification to their portfolios. After all, one of the problems with many funds (including index funds) is that an outsized percentage of their holdings will be in five or six mega-cap technology companies. Anything else is generally only going to account for a tiny proportion of the portfolio. That is not the best situation for anyone who wishes to achieve proper diversification across their portfolio. It appears that adding this fund to a portfolio might improve diversification. It does this by providing exposure to sectors that otherwise would not represent a significant weighting, and provides investors with the ability to take advantage of opportunities that may present themselves outside the technology sector.

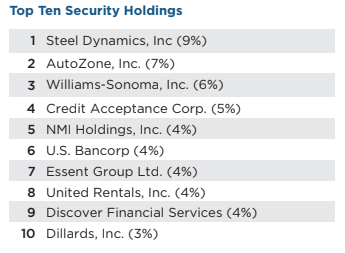

As might be expected, the largest positions in the Bexil Investment Trust are very different than we may find in most closed-end funds. Here they are:

Fund Fact Sheet

We can see here a combination of steel producers, banks, housewares retailers, a mortgage insurance company, and a few other things. It is very different from the mega-cap technology companies that tend to account for five or six of the largest positions in many other funds. Thus, the potential for diversification that this fund could offer a portfolio is quite visible here.

A few of the fund’s largest holdings also work pretty well from a dividend-earning perspective. Here are the yields of these stocks:

Company

Current Yield

Steel Dynamics (STLD)

1.42%

AutoZone (AZO)

N/A

Williams-Sonoma (WSM)

1.44%

Credit Acceptance Corp. (CACC)

N/A

NMI Holdings (NMIH)

N/A

U.S. Bancorp (USB)

4.66%

Essent Group (ESNT)

1.91%

United Rentals (URI)

0.92%

Discover Financial Services (DFS)

2.13%

Dillard’s (DDS)

0.21%

Click to enlarge

We can immediately see that three of these companies do not pay dividends, which is rather disappointing. After all, the lack of a dividend means that the fund is not earning any income from it and could probably boost its income by investing in other things. There are a few things here that have much higher yields than the market average, though, such as the two banks and Essent Group.

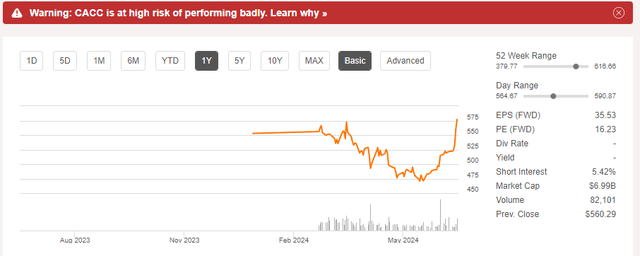

It is worth noting that a few of these stocks have rather poor projected performance. For example, Credit Acceptance Corp. is rated as likely to perform badly by Seeking Alpha’s Quant Ratings system:

Seeking Alpha

The company also has “sell” ratings by Wall Street analysts.

This complaint certainly does not apply to all the stocks that comprise the largest positions in this fund. Steel Dynamics and AutoZone both have reasonably good ratings, and U.S. Bancorp is consistently considered one of the best-run banks in the United States. However, for the most part, investors may want to do a bit of research into some of these companies before buying the fund. It will be easier to sleep at night if you have at least some confidence in the fund’s holdings, after all.

Leverage

As is the case with most closed-end funds, the Bexil Investment Trust employs leverage as a means of boosting the effective yield and total return that it earns from the assets in its portfolio. I have explained how this works in several previous articles. To paraphrase myself:

In short, the fund borrows money and uses that borrowed money to purchase stocks, partnership units, and other income-producing assets. As long as the purchased securities deliver a higher total return than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case. It is important to note though that this strategy is not as effective today with rates at 6% as it was three years ago when the fund could borrow money for basically nothing. This is because the difference between the returns that the fund can get on the purchased assets and the amount that it has to pay on the borrowed money is not as great as it once was.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to too much risk. I generally do not like a fund’s leverage to exceed a third as a percentage of its assets for this reason.

As of the time of writing, the Bexil Investment Trust has leveraged assets comprising 10.00% of its assets. This is an incredibly low level of leverage that is obviously below the one-third of assets maximum that we would ordinarily prefer.

We can see that the leverage employed by the Bexil Investment Trust is quite low by looking at how it compares to its peers:

Fund Name

Leverage Ratio

Bexil Investment Trust

10.00%

Calamos Strategic Total Return Fund

30.08%

Desta Multi-Alternative Fund

14.71%

Eaton Vance Tax-Advantaged Dividend Income Fund

19.06%

Gabelli Convertible & Income Securities Fund

8.00%

John Hancock Tax-Advantaged Dividend Income Fund

34.10%

Click to enlarge

(All figures from CEF Data.)

As we can see, there are a few peer funds that also do not employ much leverage. The Destra Multi-Alternative Fund, Eaton Vance Tax-Advantaged Dividend Income Fund, and Gabelli Convertible & Income Securities Fund all have less than 20% leverage. That is fairly rare to see among closed-end funds, as most funds have higher levels of leverage than that. This actually suggests that the Bexil Investment Trust has room to increase its leverage to boost its returns should market conditions permit it. That would be a risky move right now, though, considering the fairly high valuation of many stocks and the fact that leverage increases downside risk.

Overall, investors should not need to lose sleep over the fund’s use of leverage. It is fairly obvious that this one is not being excessive.

Distribution Analysis

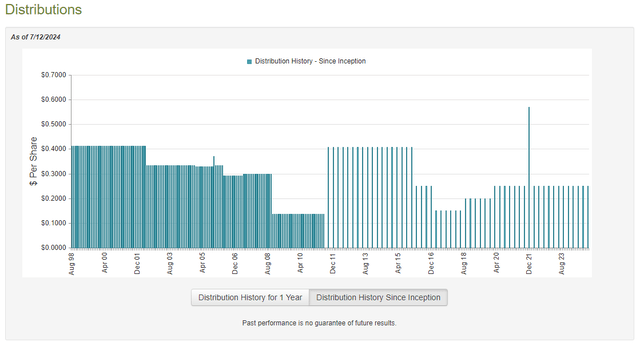

The primary objective of the Bexil Investment Trust is to provide its investors with a high level of current income. To this end, the fund pays a quarterly distribution of $0.25 per share ($1.00 per share annually). This gives the fund a 7.70% yield at the current share price.

The fund has not been especially consistent regarding its distributions over the years. Indeed, it has varied substantially over time:

CEF Connect

This is not likely to be very attractive to those investors who are seeking a reliable source of regular income. Of course, the fact that this fund pays its distribution quarterly rather than monthly could also reduce its appeal somewhat. After all, our bills and most other expenses are due monthly. The fact that the fund has been increasing its distribution since the middle of 2018 is nice, though. This is particularly so considering that inflation has been robbing us of our purchasing power for a few years now.

Naturally, we want to make sure that the fund is covering its distribution. We do not want to risk it cutting again and reducing our income. Let us take a look at the fund’s finances to see how sustainable the payment currently is.

The most recent financial report that is available for the Bexil Investment Trust is the annual report that corresponds to the full-year period that ended on December 31, 2023. While this report will not include any information about the fund’s performance over the past six months, it is the best that we have currently so it will have to suffice. A link to this document was provided earlier in this article.

For the full-year period that ended on December 31, 2023, the Bexil Investment Trust received $5,576,248 in dividends and $8,881 in interest from the assets in its portfolio. This gives the fund a total investment income of $5,585,129 for the period. The fund paid its expenses out of this amount, which left it with $894,695 available for shareholders. That was not sufficient to cover the $12,788,431 that the fund paid in distributions over the period.

Fortunately, the fund was able to make up the difference through capital gains. For the full-year period, the Bexil Investment Trust reported net realized gains of $12,099,022 along with $29,997,040 net unrealized gains. The fund’s net assets increased by $31,076,825 after accounting for all inflows and outflows during the period. Thus, the fund easily managed to cover the distributions that it paid out during the period.

We can see that the Bexil Investment Trust managed to cover its distributions solely with net realized gains and net investment income. It did not have to rely on net unrealized gains to maintain its net asset value, which is precisely what we would ordinarily want to see.

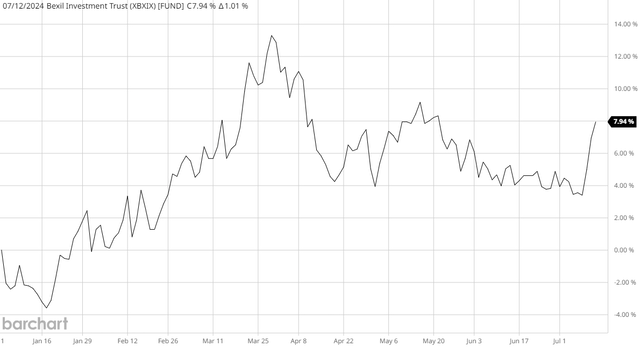

However, we need to keep in mind that the fund’s financial report is six months out of date. It appears that the fund has not been having difficulty covering its distributions this year, either. This chart shows the fund’s net asset value since December 29, 2023 (the final trading day of the previous fiscal year):

Barchart

As we can see, the fund’s net asset value has gained 7.94% since the closing date of the most recent financial report. This is an excellent sign as it tells us that the fund has managed to fully cover all the distributions that it has paid out since the start of 2024 with a substantial amount of excess returns left over.

Overall, it appears that the Bexil Investment Trust is not having any difficulty covering its distributions.

Valuation

Shares of the Bexil Investment Trust are currently trading at a massive 36.26% discount to net asset value. This is reasonably in line with the 36.62% discount that the shares have had on average over the past year. It is also one of the largest discounts that is available from any closed-end fund.

The price appears to be very reasonable right now.

Conclusion

In conclusion, the Bexil Investment Trust is a unique equity closed-end fund that is not particularly popular among many investors. There could be a few reasons for this, including the fact that this fund has underperformed its peers for quite some time. Its unique portfolio is probably a part of the reason for this, as the fund invests in very different assets than the mega-cap technology companies that have been driving the market for the past decade. Its yield is also not the highest that is available, but it does appear to be sustainable. The valuation is also incredibly attractive right now.

Overall, Bexil Investment Trust might be a decent way to add some diversity to your portfolio. It probably will not outperform the market going forward, though.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.