After a massive drop in recent days, Bitcoin and other cryptocurrencies showed signs of recovery early yesterday. As the market tries to digest the news of refunds from the collapsing Mt. Gox crypto exchange, Bitcoin prices began to rise again.

After dropping more than 8% in the past 24 hours to as low as $58,400, Bitcoin is showing signs of recovery again, surpassing the $62,000 mark.

Source: TradingView

The increase comes after concerns were raised by news that YamaGox would begin paying back $8.5 billion worth of Bitcoin to creditors starting in early July, spooking investors as they feared that YamaGox’s repayments could bring about major selling pressure on the market.

Ethereum and other cryptocurrencies

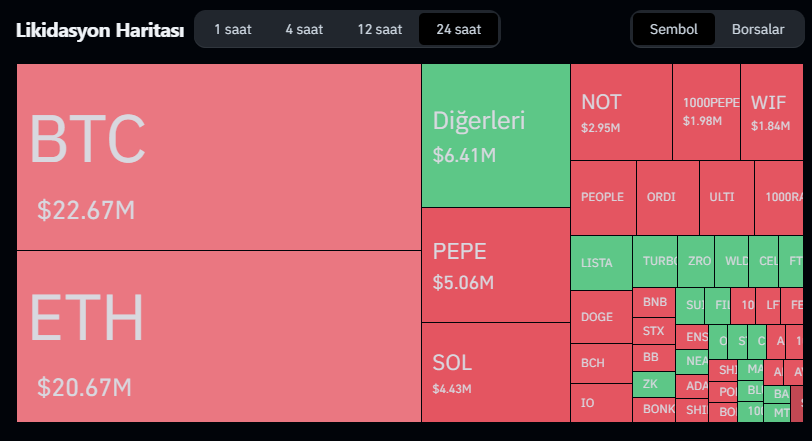

Ethereum also faced buying pressure. Comments from SEC Chairman Gary Gensler that the spot ETF review process was progressing well supported Ethereum prices. 32,081 investors experienced liquidation in the cryptocurrency market in the past 24 hours, with total liquidation exceeding $84 million. 59% of these liquidations were due to short positions. The market as a whole saw large increases, especially in meme coins and gaming tokens.

Source: Coinglass

Market Sentiments

Bitcoin open positions increased by 0.99%, which is considered a sign of new funds flowing into the market. Over the past 24 hours, the number of traders taking bearish positions in Bitcoin has decreased. Market sentiment has quickly shifted to an optimistic direction. The Crypto Fear and Greed Index rose from 30 to 46, but overall sentiment remains in “fear” mode. Analysts say the sudden change in the index reflects the high volatility inherent to the cryptocurrency market.

Market reaction

Mt. Gox’s Bitcoin refund plan has raised concerns among investors. It is also important to note that BTC does not move in tandem with Nasdaq. Meanwhile, there are rumors that some large investors and whales, such as the German government, are selling their Bitcoin holdings. These rumors increase market uncertainty and cause price fluctuations.

Long-term outlook and investment opportunities

Investors believe that if Bitcoin can sustain above certain support levels, a new wave of buying could occur. Growing interest from institutional investors and expectations of a Bitcoin ETF are among the factors that could provide long-term support. However, investors should remain cautious and flexible to market fluctuations. Moreover, growing institutional adoption and growing interest in a Bitcoin ETF could support the cryptocurrency price in the long term.

While Bitcoin’s future remains uncertain, its ability to recover from such volatility has been well documented. Market participants must remain vigilant to seize opportunities during challenging periods in the cryptocurrency market. Market participants believe that Bitcoin has generally rebounded strongly after significant declines in the past, and that the current volatility may create new opportunities for long-term investors.

As a result, Bitcoin’s path to economic immortality remains fraught with whale manipulation and macroeconomic shifts. However, Bitcoin’s propensity to challenge and exceed expectations continues to make it interesting for investors.