Fatih Karahan, the newly appointed head of Turkey’s central bank, is widely expected to stick to the country’s transition to more conventional monetary policy following the sudden departure of his predecessor, analysts said. .

Hafizeh Geyer Erkan, who oversaw a campaign to sharply raise interest rates, resigned from his top job at the central bank on Friday, citing a smear campaign in domestic media.

The move evoked memories of other late-night revolts against central bankers who raised borrowing costs in contrast to President Recep Tayyip Erdogan’s longstanding opposition to tight monetary policies.

After that, with the appointment of Deputy Governor Karahan in July, there are growing expectations that Turkey will maintain its policy of quelling the protracted inflation crisis by raising interest rates, at least for the time being.

Who is Fatih Karahan?

Karahan, President Erdogan’s sixth central bank governor since 2019, is a well-known figure in Turkish business circles. She is seen as one of the architects of the shift to more conventional monetary policy that began when Erkann was appointed as the central bank’s first female head in June.

The University of Pennsylvania-educated economist spent nearly a decade at the New York Federal Reserve before joining e-commerce group Amazon before joining Turkey’s central bank.

Callahan’s published work and professional experience have focused broadly on macroeconomics and labor markets. His experience stands in contrast to Elkann, a former Goldman Sachs banker who specialized in developing complex risk management models for banks.

“I know him as an expert who is respected by bank officials,” Hakan Kara, former chief economist at Turkey’s central bank, said of Karahan. One local banker added that Mr. Callahan is a “credible” choice to lead the bank.

What is the role of the central bank in Türkiye’s economic reform?

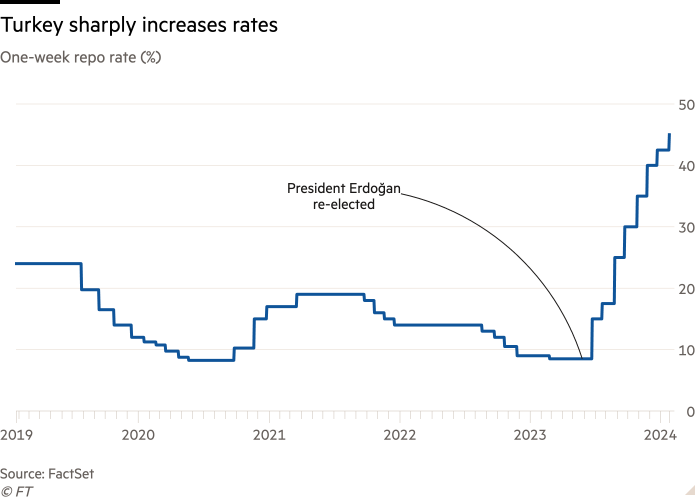

President Recep Tayyip Erdogan, who has led Turkey for the past 20 years, abruptly changed his economic policy after his re-election in May. He has abandoned unconventional policies that have caused a long-running inflation crisis, raising serious concerns that Turkey could be headed for a balance of payments crisis and capital controls by spring 2023.

In June, the president appointed Mehmet Simsek, a former Merrill Lynch bond strategist who served as deputy prime minister several years ago, as finance minister to lead the country’s economic recovery. Erkan’s appointment a few days later helped boost hopes that Erdogan is serious about reform.

The central bank, led by Erkann, raised interest rates from 8.5% to 45%. It has also taken a series of other measures aimed at curbing rampant inflation and funding growth, while encouraging local residents to hold lira rather than save in dollars or gold.

The bank’s foreign currency war chest, which had been depleted in recent years after failed attempts to prop up the lira, was rebuilt during Mr. Elkann’s tenure. Total foreign exchange reserves stood at $85 billion at the end of 2023, up from $48 billion in May, central bank data showed.

However, central banks still face major challenges in controlling inflation. Consumer prices rose by about 7% month-on-month in January, a sharp acceleration from December’s 2.9%, according to a report released by Turkey’s Statistics Authority on Monday. The annual inflation rate is almost 65%.

Economists attribute the month-on-month increase to a 49% rise in the minimum wage this year, as well as a 3.5% depreciation of the lira against the dollar since the end of December, and higher prices for imported goods.

What does this mean for investors?

Foreign investors have gradually taken an interest in Turkish assets in recent months, after having been largely kept out of Turkish markets for the past decade due to President Recep Tayyip Erdogan’s unorthodox policies.

Pimco, the world’s largest bond manager, told the Financial Times last month that it had started buying lira-denominated bonds and that Turkey could even regain investment-grade credit ratings within the next five years.

However, one of the most persistent concerns among investors is the risk of another “Arval Incident.” This refers to 2021, when President Erdoğan sacked the respected central bank governor Naci Ağbar for raising interest rates.

The initial reaction from domestic and international analysts was that Mr. Elkann’s departure was not a repeat of Mr. Agbal’s dismissal.

A senior economic official said Simsek had been given the freedom to appoint a governor who shared his beliefs about restoring traditional economic policies.

“The president has full support and confidence in the economic team and the programs we are implementing,” Simsek said on Friday.

“We are determined to maintain the necessary monetary tightening until inflation falls to levels consistent with our objective,” Callahan added over the weekend.

JPMorgan Turkey economist Fatih Akçelik told clients: [central bank] The Governor was positive about disinflation and the lira. ”

He added that Mr. Callaghan would likely be more hawkish on interest rates than Mr. Elkann, as he was part of the trio of central bank deputy governors believed to have strongly agitated for large rate hikes.

Akçelik added that the “dovish tilt” at last week’s central bank meeting, where the policymaking committee indicated that another rate hike was unlikely, would likely be reversed.

Turkey’s benchmark Bisto 100 stock index rose about 1% on Monday, while a banking sub-index sensitive to economic expectations rose more than 2%, according to FactSet data. The lira remained almost unchanged at 30.5 TL against the US dollar.

What led to Mr. Elkann’s resignation?

Rumors have been swirling in Turkish business circles for weeks since a former employee claimed in local news reports that Ercan’s father, who held an unofficial position at the central bank, had fired him.

Turkey’s opposition politicians have taken note of the drama, with one lawmaker demanding in January that Mr Şimşek answer questions related to the allegations. Mr Elkann dismissed the claims as “baseless” and “totally unacceptable”.

Just last week, President Erdogan endorsed Erdogan, saying the unnamed attackers were “trying to disrupt, with unwarranted rumors, the atmosphere of trust and stability that we have achieved with great difficulty in our economy.” It looked like it was.

Elkann said he resigned for personal reasons. “Recently, a campaign of assassination of key figures was organized against me,” he said, “to protect my family and even my innocent child.” He added that he had resigned. . . This is to avoid being further affected by this process. ”