Regions’ history is one of customer-focused collaboration.

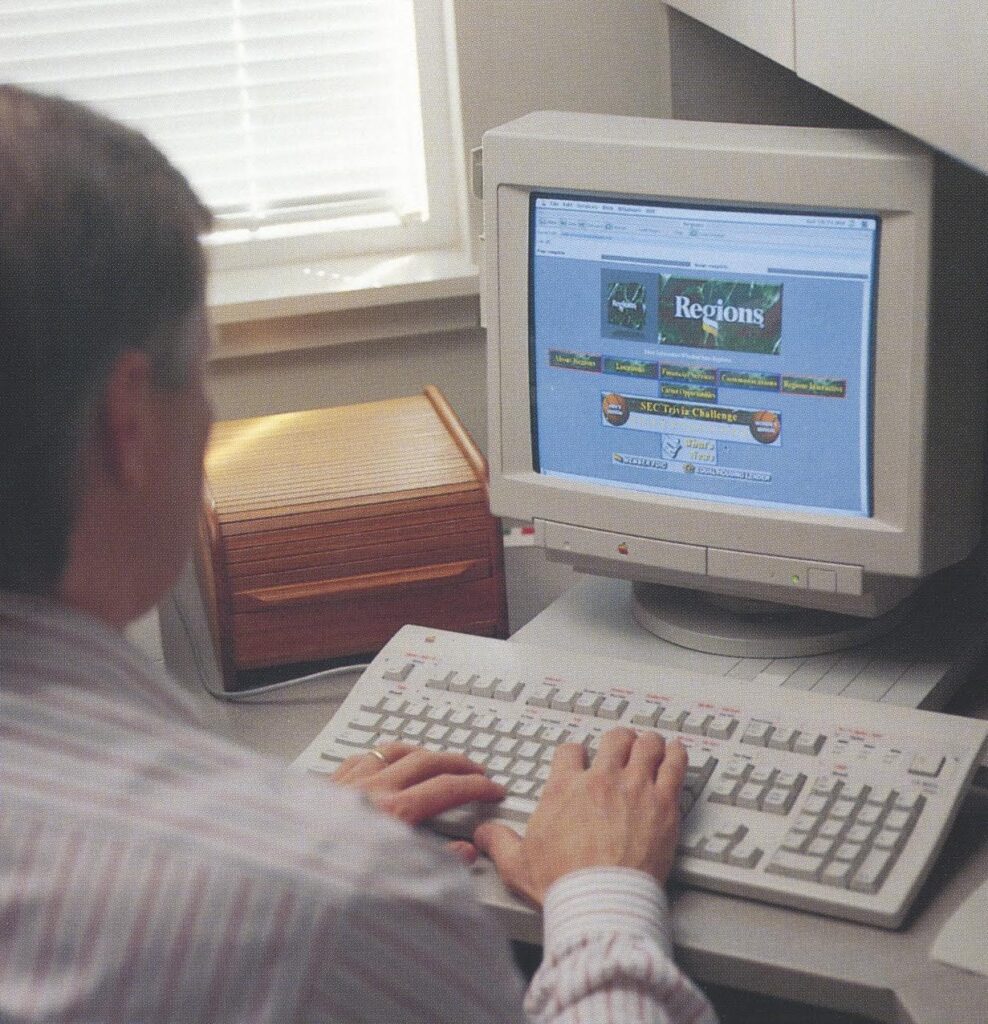

“No matter how much technology advances, banking at its core remains a people business,” explains Christian White, Birmingham Market Executive for Regions. “We have a long history of serving the people and businesses of Alabama, but at the same time, we have a clear vision for the future, from our branch network to our digital banking services.”

(Regions Bank/Contributed)

Regions’ origins date back an astounding 172 years, meaning the company that would become Regions Bank existed long before the Great Depression of the 1930s, the Great Recession of 2008 and 2009, and even the turn of the last century. The robust Regions Alabamians know today is built on a foundation of local management, strong core values, and bankers who believe in our mission to improve the lives of the people and communities we serve.

So even though Regions Financial Corporation has experienced major historical events and cultural changes as many other banks have been acquired, exited, or absorbed by other banks, it has survived by sticking together in the best interest of its customers.

So how did it all begin?

Let’s go back to 1970. Alabama had three major banks that not only survived the Great Depression, but continued to thrive, serving businesses and individuals as partners in the state’s expanding economy.

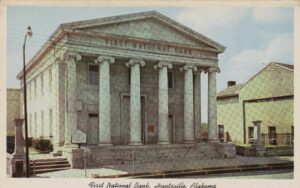

(Regions Bank/Contributed)

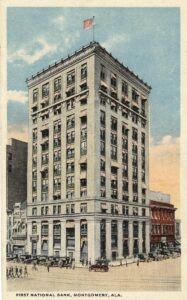

The three banks that took the lead were First National Bank of Huntsville, First National Bank of Montgomery, and Exchange Bank of Birmingham, all of which grew by acquiring more banks.

(Regions Bank/Contributed)

But as business boomed, so did the need for loans. The increased demand forced Alabama banks to work with Atlanta banks to secure sufficient loan amounts for their customers; the First National Bank of Montgomery’s loan limit at the time was $640,000. While the Atlanta banks were often used as a useful resource, tensions arose as they began calling Alabama customers to cut out the middleman.

For example, Brandt Brothers Construction, a longtime client of First National Bank of Montgomery, was unable to get a loan because the size of the bank determines the amount of the loan.

“He was forced to leave town to meet the company’s credit requirements,” said Frank Plummer, who became executive vice president of First National Bank of Montgomery in 1953.

Frustrated by his inability to serve his loyal customers, Plummer came up with a plan of action: He brought together Norman Press of Exchange Securities and Robert Lawrie of First National Bank of Huntsville to form a holding company.Congress passed the Bank Holding Company Act in 1956, allowing banks to form holding companies to acquire other banks in the state where the acquiring bank was headquartered.

The merger would give the banks combined assets of $446 million and allow them to lend more. The application was filed on July 2, 1970.

(Regions Bank/Contributed)

It wasn’t the end

After a hearing in September 1970, the bank examiner ruled against the formation of the bank holding company. “We lost the first round,” Plummer said. But through their continued collaboration, Press, Lawrie and Plummer stuck to their values and fought for their customers and their state. As a result, the new bank holding company was approved, and the company that would become Regions Financial was established and laid the foundation for a thriving business.

Read more

(Regions Bank/Contributed)

Between 1972 and 1997, more history was made: legislation was passed allowing the bank to expand by acquiring or being acquired by out-of-state banks, the affiliate renamed itself First Alabama Bank, and eventually Regions Bank to reflect its expansion throughout the South, acquiring branches in Florida, Georgia, Louisiana, and Tennessee. As readers will recall, the merger began most notably in May 2006, when Regions Bank agreed to acquire AmSouth. The deal was completed six months later, and by December 2007, all AmSouth branches bore the Regions Bank name and logo.

Years ago, Frank Plummer said, “Our business is to serve our customers, our employees, our shareholders and our community. That was our primary goal back then.”

“While our customer service methods have evolved over time, our focus remains the same,” White concluded. “We don’t just exist to open accounts or issue loans. We exist to build relationships with our customers and leverage the insights of our team across more than a dozen states to help them find the best financial options to achieve their unique goals.”