Bell Food Group (VTX:BELL) has had a tough month, with its share price down 9.0%. However, share prices are usually driven by a company’s long term financial performance, which in this case looks quite promising. Specifically, we decided to investigate Bell Food Group’s ROE in this article.

Return on equity (ROE) is an important factor for shareholders to consider because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio that measures the rate of return on the capital provided by the company’s shareholders.

Check out our latest analysis for Belfood Group

How is ROE calculated?

The formula for calculating ROE is as follows:

Return on Equity = Net Income (from continuing operations) / Shareholders’ Equity

So, based on the above formula, Belfood Group’s ROE is:

8.6% = CHF 130m ÷ CHF 1.5bn (Based on the trailing 12 months to December 2023).

“Returns” refers to the company’s earnings over the past year – one way to conceptualize this is that for every CHF 1 of shareholders’ equity, the company made CHF 0.09 in profit.

What is the relationship between ROE and profit growth?

Thus far, we have learned that ROE is a measure of a company’s profitability. Based on how much of its profits a company chooses to reinvest or “retain”, we are able to evaluate a company’s future profit-generating ability. Generally, all else being equal, companies with higher return on equity and retained profits have higher growth rates than companies that don’t have these attributes.

Belfood Group’s revenue growth and 8.6% ROE

Firstly, Belfood Group’s ROE seems high. Still, it is not very encouraging when compared to the industry average ROE of 15%. However, it is definitely positive that Belfood Group’s net profit growth over the past five years has been moderate at 15%. We believe that other factors may have influenced this, such as high profit retention and efficient management structure. Keep in mind that the company’s ROE is at a high level; it’s just that the industry average ROE is higher. So, this also adds some color to the company’s fairly high profit growth.

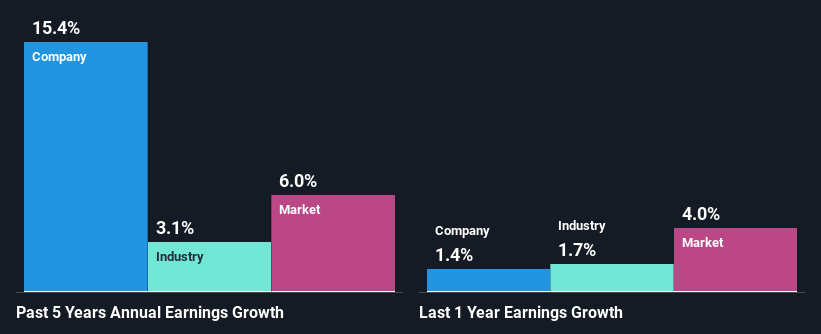

Next, we compared Belfood Group’s net profit growth with the industry and found that the company’s growth rate is higher when compared to the industry which recorded a growth rate of 3.1% over the same five-year period.

Earnings growth is an important metric to consider when valuing a stock. It is important for investors to know if the market has priced in a company’s expected earnings growth (or decline). This helps them determine if the stock is poised for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio, which determines the price the market is willing to pay for a stock based on its earnings outlook. Therefore, it may be a good idea to check whether Belfood Group is trading at a high or low P/E compared to its industry.

Is Belfood Group using its retained earnings effectively?

Belfood Group’s three-year median dividend payout ratio is at a reasonable level of 34% (or a retention ratio of 66%), and as mentioned above, its profits have been growing quite well, showing that it is using its profits efficiently.

Additionally, Belfood Group has been paying dividends for at least 10 years, which means the company is pretty serious about distributing profits to shareholders. Based on the latest analyst forecasts, the company’s dividend payout ratio over the next three years is expected to remain stable at 35%. As a result, Belfood Group’s ROE is also not expected to change much. This is inferred from analysts’ future ROE forecast of 8.6%.

Conclusion

Overall, we are very pleased with Belfood Group’s performance. It’s particularly great to see the company is growing its earnings strongly, backed by a respectable ROE and a strong reinvestment rate. That said, when we looked at the current analyst forecasts, we were concerned to see that while the company has grown its earnings in the past, analysts are expecting earnings to fall in the future. If you want to know more about the company’s future earnings growth forecasts, you can take a look at this free report on analyst forecasts for the company.

Valuation is complicated, but we can help make it simple.

Find out if Bell Food Group is overvalued or undervalued by checking our comprehensive analysis, including fair value estimates, risks and warnings, dividends, insider transactions, financials and more.

View your free analysis

Have feedback about this article? Concerns about the content? Please contact us directly or email us at editorial-team (at) simplywallst.com.

This article by Simply Wall St is of general nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives or financial situation. We aim to provide long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned herein.

Valuation is complicated, but we can help make it simple.

Find out if Bell Food Group is overvalued or undervalued by checking our comprehensive analysis, including fair value estimates, risks and warnings, dividends, insider transactions, financials and more.

View your free analysis

Have something to say about this article? If you have any questions about the content, please contact us directly or email us at editorial-team@simplywallst.com.