Looking at Oriental Food Industries Holdings’ (KLSE:OFI) recent performance, it’s hard to get excited about the stock, with it down 5.2% over the past month. However, share prices are usually driven by a company’s long term financial performance, which in this case looks quite promising. Specifically, in this article we decided to look at Oriental Food Industries Holdings’ ROE.

Return on Equity (ROE) is a measure of how effectively a company is growing its value and managing investors’ money. In other words, it is a measure of how successful a company is at converting shareholder investments into profits.

Check out our latest analysis for Oriental Food Industries Holdings Berhad

How do you calculate return on equity?

The formula for return on equity is:

Return on Equity = Net Income (from continuing operations) / Shareholders’ Equity

So, based on the above formula, the ROE for Oriental Food Industries Holdings Berhad is:

16% = RM43m ÷ RM263m (Based on the trailing twelve months to March 2024).

“Revenue” is the income a company earned over the last year. Another way to look at this is that for every MYR1 worth of capital, the company was able to earn a profit of MYR0.16.

What is the relationship between ROE and earnings growth?

We’ve already mentioned that ROE is an efficient predictor of a company’s future earnings. Depending on how much a company reinvests or “retains” these profits, and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, all else being equal, companies with higher return on equity and retained profits will have higher growth rates than companies that don’t have these attributes.

Oriental Food Industries Holdings’ Revenue Growth and 16% ROE

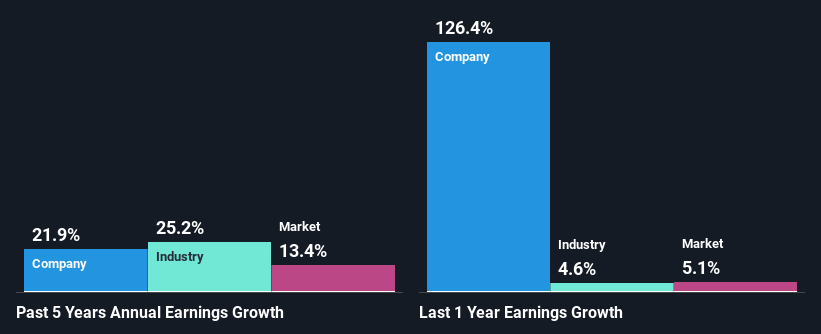

Firstly, Oriental Food Industries Holdings Berhad appears to have a respectable ROE. Moreover, the company’s ROE compares quite favorably to the industry average of 8.3%. This is likely the basis for Oriental Food Industries Holdings Berhad’s impressive net income growth of 22% over the past five years. However, there could also be other reasons behind this growth. For example, the company’s management could have made good strategic decisions, or the company’s dividend payout ratio could be low.

We then compared Oriental Food Industries Holdings Berhad’s net income growth with the industry, revealing that the company’s growth is in line with the industry average growth of 25% over the same five-year period.

The story continues

Past Revenue Growth

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is whether the expected earnings growth, or lack thereof, is already priced into the share price. This will help them determine whether the stock is headed for a brighter or bleak future. Is Oriental Food Industries Holdings Berhad fairly valued relative to other companies? The following three valuation metrics may help you decide:

Is Oriental Food Industries Holdings Berhad using its profits efficiently?

Oriental Food Industries Holdings Berhad’s three-year median dividend payout ratio is fairly low at 37%, meaning the company is retaining 63% of its earnings.It therefore appears that Oriental Food Industries Holdings Berhad is reinvesting efficiently in a way that has produced impressive earnings growth (discussed above) and a well-covered dividend payment.

Moreover, Oriental Food Industries Holdings Ltd is determined to continue sharing profits with shareholders, judging by its long history of paying dividends for at least 10 years.

summary

Overall, we feel that Oriental Food Industries Holdings Berhad is performing very well. We particularly like that the company is reinvesting a large portion of its profits at a high rate of return. This has naturally led to the company’s earnings growing strongly. If the company continues to grow its earnings as it has, this could have a positive impact on the share price, given how earnings per share affect share prices in the long term. Not to forget, business risk is also one of the factors that can affect share prices. Therefore, this is also an important area that investors need to pay attention to before making any business decisions. To see the 1 risk we have identified for Oriental Food Industries Holdings Berhad, visit our risks dashboard for free.

Have feedback about this article? Concerns about the content? Please contact us directly or email us at editorial-team (at) simplywallst.com.

This article by Simply Wall St is of general nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives or financial situation. We aim to provide long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned herein.

Have something to say about this article? If you have any questions about the content, please contact us directly or email us at editorial-team@simplywallst.com.