Justin Sullivan/Getty Images News

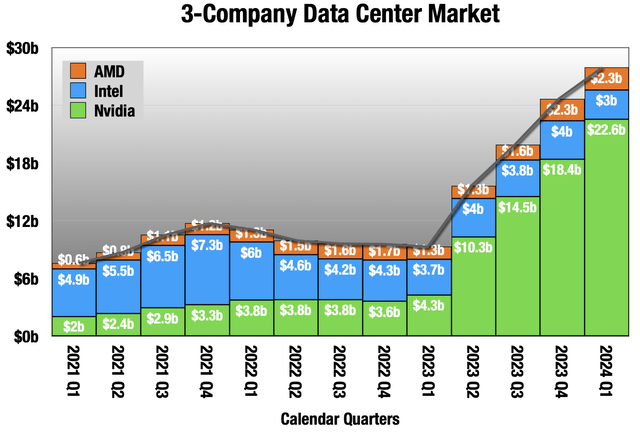

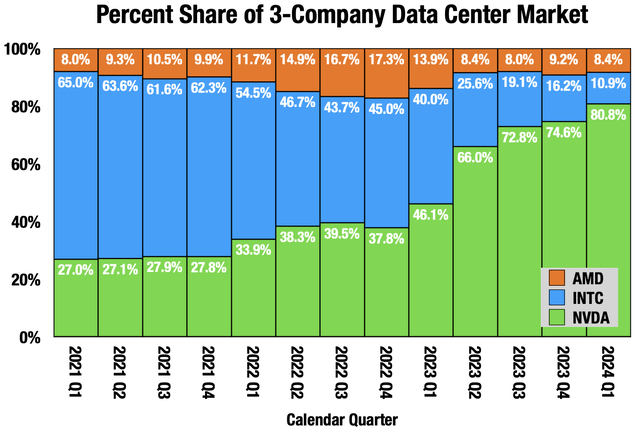

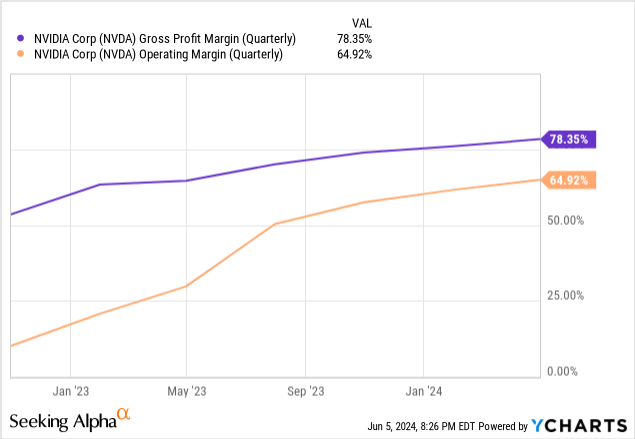

I mean, look at this graph

Nvidia has been on a slow reporting pace, with its most recent quarter ending in April instead of March like the other two quarters. (Quarterly Earnings Report)

I’m struggling to find anything new to say about NVIDIA Corporation (NASDAQ:NVDA) and the rapid growth of its data center segment, which grew 427% year over year in the first quarter that ended in April. NVIDIA is driving out other data center investments, especially CPU servers.

Nvidia has been on a slow reporting pace, with its most recent quarter ending in April instead of March like the other two quarters. (Quarterly Earnings Report)

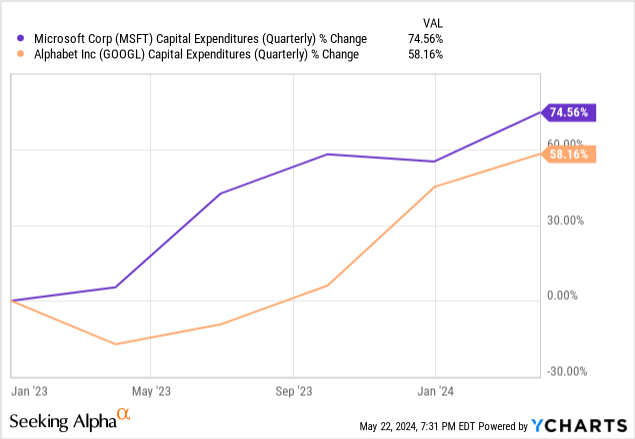

And customer capital investments are ballooning.

Data by YCharts

Data by YCharts

Extraordinary.

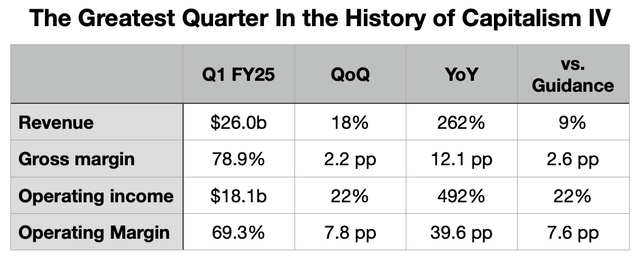

quarter:

Nvidia Q1 report

Not only is the company outperforming its peers, it also beat its own guidance from three months ago (right column), marking the fifth consecutive quarter that guidance has fallen short of target.

What else can be said about this kind of performance other than to ask when it will end? It’s not over yet.

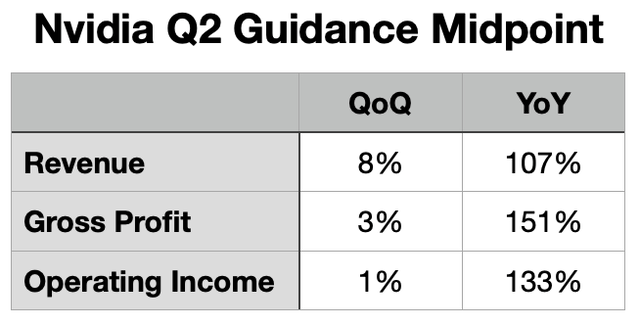

guidance

Here are three things we know:

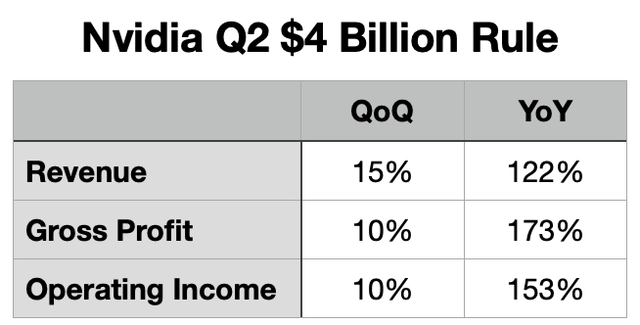

Demand for Nvidia GPUs is far outstripping supply. The main bottleneck is Taiwan Semiconductor Manufacturing Company Limited’s (TSM) advanced packaging capacity. The company had to triple this over the 18 months since August last year, meaning it will be a little more than halfway through the build by June 2024. Since TSM began building out, Nvidia has been able to increase data center revenue by about $4 billion in each of the past three quarters. Nvidia’s guidance was for roughly $2 billion per quarter increase, but the pace of TSM’s advanced packaging buildout appears to be significantly faster than that.

When I was asked on the morning of Nvidia’s earnings release how much I thought the company would make, I flippantly said $26 billion. What I really meant was last quarter’s revenue plus $4 billion. And $26 billion was spot on.

They are again forecasting an increase of $2 billion quarter-over-quarter.

Nvidia Guidance; Trading Places Research

And applying my “4 billion dollar rule” we get:

Nvidia Guidance; Trading Places Research

As you know, these year-over-year numbers are still triple digits, but they’re decelerating rapidly from the past four quarters. Reported quarterly revenues were up 262% year-over-year. You may note that this is the largest quarterly IV in capitalist history, and by my calculations, the equivalent of a year. So we go from the easy year-over-year comparisons before all this really started to more difficult comparisons, where growth rates slow, but we’re still in the triple digits.

This raises the possibility that we may see signs of a slowdown in the next quarter despite triple-digit growth. I think expectations are firmly anchored on this front, but it remains to be seen how the response will be.

You may notice that these figures also incorporate margin losses. This comes from two sources.

Cost of goods sold has been driven down by declining component costs, but the company is warning that this will end this year. This will result in a 2-3 percent decline in gross margins. Operating expenses have been growing at over 40% annually. With triple digit revenue growth, this is not something to be too concerned about, but if this continues, it will hurt at some point.

So the outlook is for more phenomenal growth, offset by some margin compression. My model projects a one-year-ahead PE of around 33x, which isn’t that high given the growth and margins.

Nvidia takes all the money

A few weeks after Nvidia’s report, two of its customers in the server market, Dell Technologies Inc. (DELL) and Hewlett Packard Enterprise Company (HPE), reported that the majority of the money spent on these GPU servers is going to Nvidia’s hardware, leaving the rest for other companies.The best evidence of the supply and demand dynamics is Nvidia’s booming profit margins.

Data by YCharts

Data by YCharts

A 78% gross margin is unheard of for datacenter hardware. Nvidia can achieve such margins because demand is there and supply remains constrained; they have few real competitors (yet) and therefore little pricing pressure.

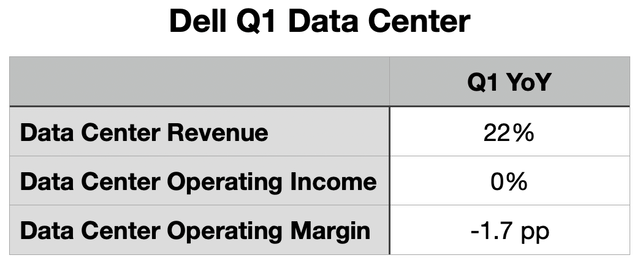

Nvidia leaves customers with leftovers. Dell was the first to report it, so let’s start there.

Data centers account for about 40% of Dell’s revenue (Dell Quarterly Report, Trading Places Research).

A 22% increase in data center revenue is pretty impressive, but flat operating income and declining operating margins are less so. In effect, Dell sold $1.6B in AI servers but had a 0% operating margin because Nvidia already got all of it.

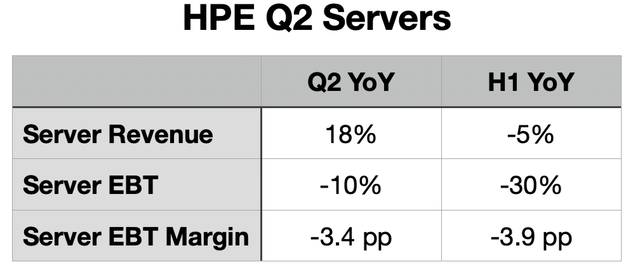

Moving on to HPE, the situation is even worse. They just released their second quarter results, so let’s look at their first half results as well.

Servers account for roughly half of HPE’s revenue (HPE Quarterly Report, Trading Places Research)

After a terrible Q1, server revenue has rebounded and AI server sales have increased significantly. The problem for them is that EBT margins appear to be negative. Revenue increased 18% year over year, but EBT margins fell from 14.4% to 11.0%, with EBT down 10%. Add the terrible Q1 to the H1 numbers and you get an even more dire picture with EBT margins falling by 4 percentage points.

Because Nvidia has already received all the money.

Never before has one company dominated data center spending like this, but it is now a reality.

Two other things

A 10-for-1 stock split. The company also repurchased $7.8 billion in stock, the largest quarterly buyback on record.

Neither was unexpected, but frankly, both were a bit late. I’ve been hoping for a stock split since the stock price hit $500 (every company should split their stock at $500). I expected the accelerated buybacks to happen last quarter. But either way, better late than never, and both are welcome news. The stock split makes the shares more accessible to more investors, and the buybacks should reduce the share count by at least 1% next year.

Hilariously, they increased their meager dividend by 150% to $0.10 per quarter so that it wouldn’t drop a cent after the split. Hilariously, that’s a yield of 0.04%. Why would they do that?

Conclusion

I’m really running out of things to say about this. This is not normal. This is the most amazing thing I’ve seen in my 40 years of watching the market. Nvidia waited nearly 20 years for their data center GPU to be an overnight success, but the wait has been worth it. This is success on a scale they never dreamed possible.

They are sucking up data center spending and crowding out everything else. Capital costs to their customers are inflating.

Everything changed in an instant, but I see this as an investment bubble. Although there are at least three quarters left. At Long View Capital, we have been discussing the “$200 billion question.” VC firm Sequoia Capital has made a lot of AI investments, and much of their money goes to buying GPU computing, but they have published an unusually sober assessment of the situation. They estimate that $50 billion was spent on Nvidia GPUs alone last year. Furthermore, they estimate that this investment requires $200 billion in revenue to pay for the GPUs and everything else, and that in 2023 there will only be $3 billion in AI revenue. This is the $200 billion question. Where will the revenue come from to justify all this spending? Currently, investors are okay with the spending, but that could change soon.

The questions remain: Where is the revenue-generating demand? What is the value proposition? Microsoft Corporation’s (MSFT) very expensive Microsoft 365 Copilot is a great test case for us. It’s a $30/month add-on to Microsoft 365, which costs $22/month. Microsoft’s core competency is driving new software through enterprise sales channels. If Microsoft’s sales team can’t do this, I don’t know who can.

The history of AI is marked by big leaps followed by years of stagnation. The last of these cycles began in 2012 with the famous AlexNet and ended in AI winter in 2015. Investment began to dry up as other software, especially enterprise SaaS, looked more promising. This new cycle began in late 2022 with the release of ChatGPT 3.5, followed shortly thereafter by the much more performant GPT 4.0. When will it end?

I think this Nvidia Corporation bubble will continue for at least another three quarters, but it’s still a bubble. We should have a better idea of what 2025 will look like in a few more months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.