Turkish President Recep Tayyip Erdogan made official visits to Saudi Arabia, Qatar and the United Arab Emirates (UAE) this week, cementing a new era of economic cooperation with a Gulf region that has gained strategic independence from the West.

The visit built on Erdogan’s visit to the UAE more than a year ago and marked a new chapter in strengthening political and economic ties between the two countries ahead of Turkish elections in May 2023.

After his reelection, Erdogan reinstated Mehmet Simsek as finance minister, putting the former investment banker back in charge of the treasury. Simsek’s appointment signaled a return to economic orthodoxy and a priority on market stability, giving Gulf investors confidence in Turkey’s investment climate. It has raised hopes for an economy facing soaring inflation, a chronic current account deficit, a devaluation of the lira and a depletion of badly needed foreign exchange reserves.

President Erdogan’s reelection and Şimşek’s appointment signal a growing momentum toward normalization with the Gulf region, which began with reciprocal official visits in 2021. Şimşek has already held high-level meetings in Saudi Arabia, Qatar and the UAE in June this year, laying the groundwork for Erdogan’s most recent visit and helping to foster bilateral economic ties.

Turkey’s developing relations with these three Gulf states indicate convergence of interests and agreements on many issues. These include agreements on complementary comparative advantages, eagerness to diversify trade partnerships, and aspirations for strategic independence from the West. Reflecting growing cooperation, Turkey announced a bilateral investment framework agreement with the UAE worth more than $50 billion. It also announced agreements with Saudi Arabia and Qatar (amounts not yet disclosed). Deepening partnerships in key areas such as defense, energy, and transportation indicate Turkey and the Gulf states are seeking to leverage their financial capital, know-how, and geographic advantages for economic growth. They also signal a realignment to share political risks in a volatile region and reduce dependency on the United States.

A strong foundation

Turkey’s renewed interest in strengthening ties with the Gulf is primarily driven by a desire to attract capital inflows and maintain Erdogan’s legacy as a leader who brought economic growth over the past two decades. After a temporary slowdown due to political turmoil between 2013 and 2020, trade between Turkey and the Gulf reached $22 billion, according to the Turkish government. Turkey has ambitious plans to nearly triple that figure over the next five years.

Gulf countries are also keen to expand their presence in Turkey. Gulf Cooperation Council (GCC) countries accounted for 7.1% of foreign direct investment in Turkey since 2020, with a stock of $15.8 billion as of 2022. Qatar has invested $9.9 billion in Turkey among the GCC countries, followed by the UAE with $3.4 billion and Saudi Arabia with $500 million. This amount is expected to double to $30 billion in the coming years through investments prioritizing the energy, defense, finance, retail and transport sectors. To date, the UAE and Qatar have provided Turkey with $20 billion in currency swap agreements, while Saudi Arabia has deposited $5 billion in its central bank to support dollar liquidity.

But the new agreements signed during Erdogan’s visit focus on capital investment in productive assets such as land, factories and infrastructure. Abu Dhabi Development Holding Sovereign Wealth Fund (ADQ) alone signed a memorandum of understanding to lend up to $8.5 billion for Turkey earthquake relief bonds and provide a $3 billion line of credit to support Turkish exports. Taken together, these are evidence of a long-term vision for the GCC and Turkey to work more closely together at a strategic level.

Economic cooperation has also attracted Turkish investment to the Gulf, mainly in the construction and services sectors such as information technology, communications and agricultural technology. Defense industry collaboration between Turkey and the Gulf, such as the production of Baikal’s Akinczy or TB2 unmanned aerial vehicles, could also elevate the relationship beyond the economic sphere. For Saudi Arabia, which has a domestic factory producing Turkey’s Vestel Karael drones, primarily intended for reconnaissance missions, the Akinczy could take drone combat doctrine to a new level.

Mutual Benefit

This developing partnership is clearly a win-win situation. Turkey’s and the GCC countries’ geography connects three lucrative sub-regions – the Gulf, the Eastern Mediterranean and the Black Sea – helping the countries build connections and increase interdependence in an increasingly volatile world. With a combined Gross Domestic Product (GDP) of $1.8 trillion, Saudi Arabia, Qatar and the UAE have abundant resources and significant comparative advantages – not only in their oil and gas sectors, but also in their robust legal frameworks, world-class infrastructure and relative ease of doing business.

For example, the UAE is implementing social and business reforms to attract foreign investment. The country also has a young, tech-savvy, talented population that is eager to learn and determined to make an impact in emerging fields such as artificial intelligence and robotics. Turkey, on the other hand, has comparative advantages in the defense, hospitality and construction sectors. Turkey has traditionally been a capital-poor, labor-intensive country that faced worsening terms of trade, especially since joining the European Customs Union in 1995. However, gradually through technological improvements and investments in capital-intensive sectors, Turkey has repositioned itself as an alternative industrial hub in the emerging markets of the Middle East. As a member of the G20, Turkey has become a diversified, technologically advanced and sophisticated economy.

Turkey is currently eager to expand its bilateral comprehensive economic partnership agreement into a multilateral agreement with the GCC. Moreover, the February 2023 earthquake is estimated to have cost Turkey $104 billion in infrastructure damage and economic losses, equivalent to 12% of GDP, and Turkey needs to diversify and deepen its trade partnerships to recover quickly.

Non-aligned, interconnected

The main driving force behind this increased economic cooperation is a drive to gain strategic independence from the West and diversify risks in preparation for a change in US policy toward Turkey and the Gulf countries after the next US presidential election. Turkey and the Gulf countries have emerged as non-aligned middle powers adapting to a multipolar world as the center of gravity of the global economy shifts to the Indo-Pacific region.

The war in Ukraine has increased Turkey’s geopolitical importance and given it an advantageous position in negotiations with the United States and NATO, as was evident at last week’s Vilnius summit. Continued Russian aggression and associated Western sanctions have also led Turkey to look to the Gulf for alternative sources of hydrocarbons. Windfall profits from oil and gas sales have boosted the coffers of Gulf sovereign wealth funds, who are now looking to expand non-oil trades and diversify their portfolios into sustainable long-term investments such as renewable energy, advanced technology, healthcare, tourism and leisure.

Several big deals symbolize these diversification efforts. At the Arab-China Business Conference in Riyadh in June this year, investment deals worth $10 billion were signed between Arab countries and China. Iraq is developing a $17 billion railway that will run through Turkey to Europe, a project that has also drawn interest from GCC countries. Abu Dhabi Development Holding Company and the Turkish Wealth Fund launched a $300 million partnership to invest in Turkish technology startups. The UAE is also keen to invest in Istanbul’s metro and a high-speed rail line to Ankara. The two countries aim to increase trade from $18 billion to $40 billion over the next five years.

Ultimately, this surge in new investments shows that the Gulf states and Turkey see each other as mutually beneficial partners, and Erdogan’s visit to the Gulf states this week further reaffirms the deepening economic partnership between the two countries, which could have long-term strategic implications.

Serhat S. Çubukçuoğlu is Senior Fellow in Strategic Research at TRENDS Research & Advisory, Abu Dhabi.

Mouza Hasan Almarzooqi is an economics researcher at TRENDS Research & Advisory in Abu Dhabi.

References

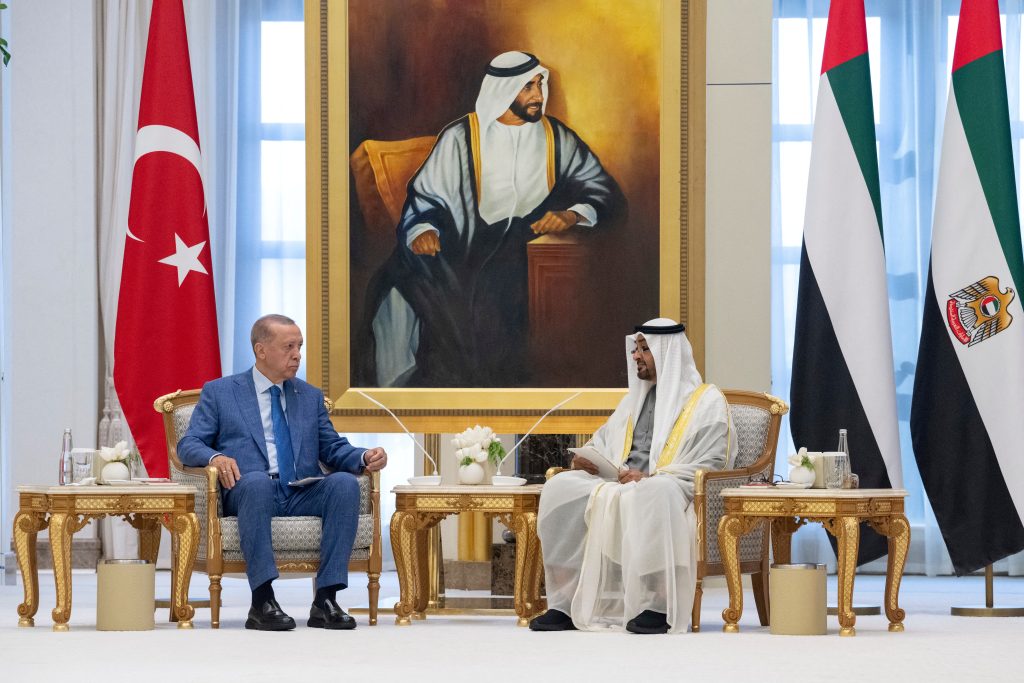

Photo: UAE President Sheikh Mohamed bin Zayed Al Nahyan meets with Turkish President Recep Tayyip Erdogan during an official reception at Qasr Al Watan in Abu Dhabi, UAE, 19 July 2023. Hamad Al Kaabi/UAE Presidential Court/Distributed via Reuters. This image has been provided by a third party.